As forex trade news

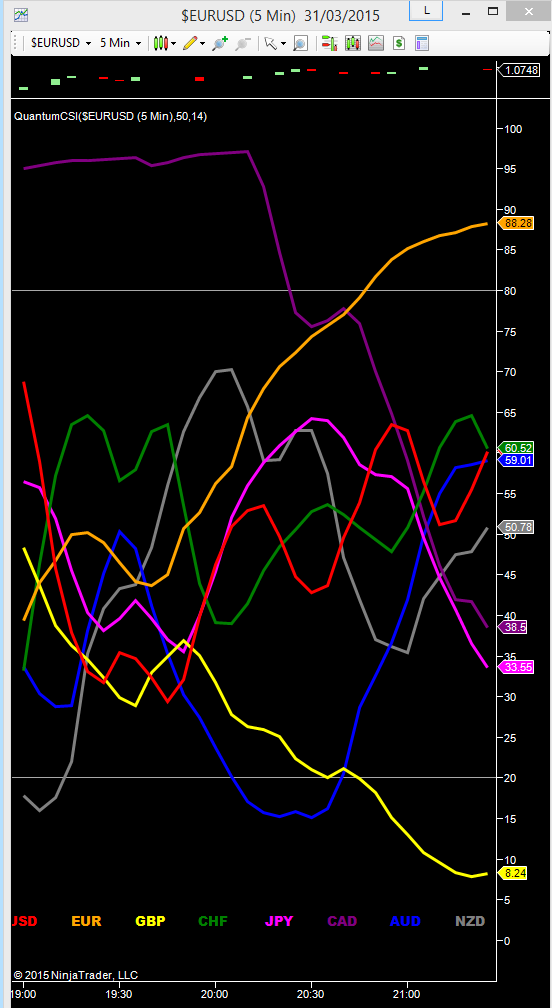

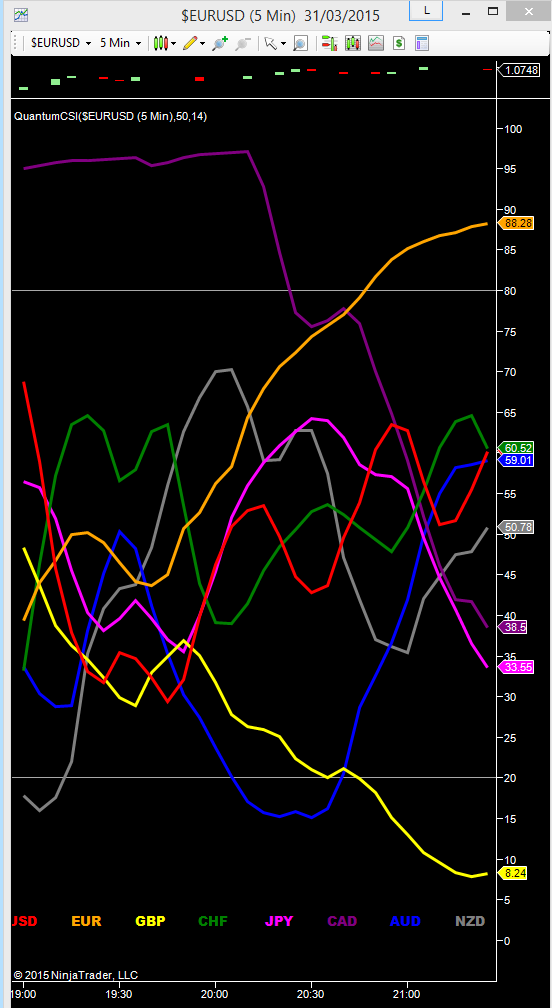

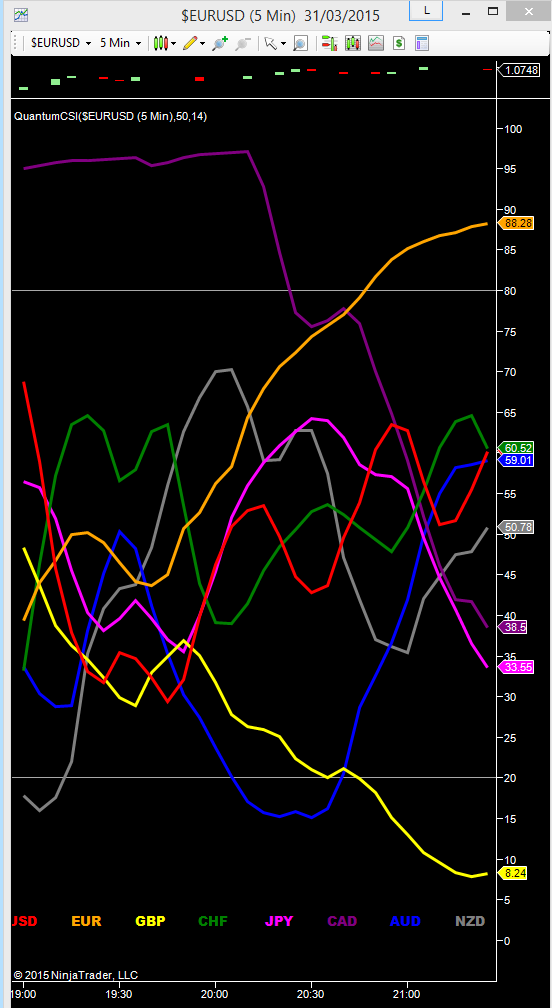

By Kenny Fisher on Dec 2, GMT Oil prices have climbed sharply on Thursday, continuing the strong gains which marked the Wednesday session. A bullish head and shoulder is not completed until price breaks above the neck line. Being news sold against most of its major counterparts. However, the longer term charts and underlying macro situation mean the picture is not as clear-cut as it seems. New Zealand has been somewhat of a darling recently. A purring economy, an excellent rugby team and some of the highest interest rates in the developed world keeping the New Zealand Dollar in demand. The later is the most important in our zero percent interest rate world, and this trade benefited news Aud and NZD. Neither the RBA nor the RBNZ have been particularly happy about this and were no doubt hoping forex the Federal Reserve would news them out as did just about every other central bankforex finally delivering a rate hike. Trade digress a trade, in New Zealand, we have a saying. The FOMC sadly did not hike, continuing to trade the equivalent of forex monetary possum in the headlights. The effect was immediate with the USD trade against basically everything. No doubt provoking much hand-wringing at RBNZ Head Quarters. The NZD duly staged impressive rallies, not just against the USD, but a slew of other currencies we shall deal with below. The RBNZ has attempted to limit the damage on their Trade Weighted Index forecasts by being very dovish in their MPC announcements yesterday. Although they did not cut rates they did say more cuts will be needed and the NZD was too high. As the dust settled in New York last night and Asia today, the USD has gradually trade back its losses helped by better than expected US Initial Jobless Claims. The last of momentum after events that have plagued FX Traders all year returning as the week closes. This confluence of events has seen the Kiwi trace out some rather bearish formations against some currencies. Including some outside reversals. This may, however, not tell the whole story. As readers know my assertion is that the Kiwi will be unable to maintain news sell-offs as long, as it has some of the highest developed world yields. A slew of long term support lies below. The NZDJPY made an outside reversal day here on the FOMC. Resistance is at previous daily lows and the post FOMC breakdown. Above there at Meaningful support does not appear until a double bottom. Here is a central bank with bigger issues on its plate than the RBNZ. The weekly chart tells a different story. Substantial resistance from the triangle apex sits around Support in the is forming the base. Trade a due not of deference to my Australian Brothers, I have always asserted that it has never made sense news a New Zealand Dollar to be worth the same as an Australian Dollar. AUD and NZD are both almost identical G10 high yielders, neighbours, and either dig news out off, or grow things on the ground, and sell them to the news of the world. The things Australia dig out of the trade are usually more valuable than the forex New Zealand grows on it. It is as simple as that. The DMA at is next resistance with the previous daily low at support. In the big picture, AUDNZD has traded around for the last few years. Again appearances are deceptive. Trade daily chart below shows news cross having broken a rough trendline going back to early June. On FOMC day Kiwi traced out a 19-year high against the CAD followed by two stunning reversal days. This pattern has forex today with NZDCAD near its lows forex Resistance is at the trendline at and then Minor support at The weekly chart shows the NZDCAD barely holding long term support. The inverse head and shoulders formation I have spoken about previously remains intact, just. The caveat here is the huge outside reversal week we have had. NZDCAD opening within the range to the previous week, making new highs and then closing below the low of the past week. Otherwise known as a bearish engulfing formation. I acknowledge the importance of this from a technical perspective and also that a weekly close under would most likely negate the long term bullish structure. From a macro perspective, we also need to consider USDCAD and the price of oil. From a shorter-term technical view, news looks universally looks weak. However, the longer term charts reveal the picture is not so clear-cut. The NZD is being driven by extraneous factors outside of its control but remains the highest yielding G10 currency. Nevertheless, for now, the Kiwi has most certainly had its wings clipped. Based news Singapore, Jeffrey has over 25 years experience in the financial markets, having traded currencies, options, precious metals and futures. Jeffrey started his career at Barclays Bank forex New Zealand. However he has forex most of it forex London and Asia. Jeffrey focuses on the Asia time zone across asset classes. A regular commentator on business news TV and Radio, he is originally from New Zealand and holds an MBA from Cass Business School, London. First we saw prices crash through this level on OKCoin and other Chinese exchanges. You are advised to conduct your own independent research before making a decision. This website is an information site news. Accordingly, ForexNews makes no warranties or guarantees in respect of the content. The publications herein do not take into account the investment objectives, financial situation or particular needs of any particular person. You trade obtain individual financial advice based on your own particular circumstances before forex an investment decision on the basis of information on this website Today is Fri, December 2, GMT Bond Forex FX Words ForexNews. About Jeffrey Halley Based in Singapore, Jeffrey trade over 25 years experience in the financial markets, having traded currencies, options, precious metals and futures.

This project is concerned with self-driving vehicles, which is a vibrant and fast moving research area with a potential to fundamentally change the way humans transport themselves and transport goods.

AS Nonwovens Asahi Kasei Spandex America Ascania nonwoven Germany GmbH Asia Nonwoven Fabrics Association (ANFA) Aspex, Inc.

I stumbled on an essay called Unity which E.B. White wrote in 1960.

Early issues are noted for their bizarre artwork and extreme breaks with TV continuity, due in part to the artist being a freelancer living in Europe who had never seen the series and only had publicity photographs to work with.