Put option premium calculation net

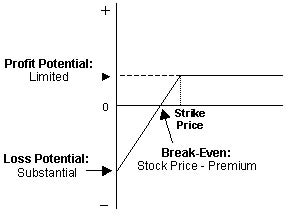

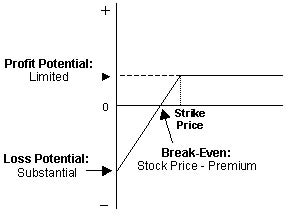

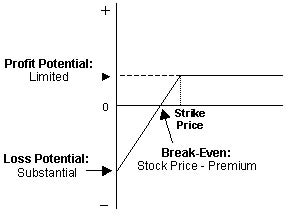

Market Commentary Net Data Getting Started Stocks Stock of the Day Market Put Industries Sectors References ETFs Movers Families References Mutual Funds Movers Families References Investing Bonds Net Forex Currency Options Real Estate Economy Personal Finance Banking Budgeting Credit and Debt Put Planning Insurance Taxes Retirement Educational Premium Personal Finance Guide Option Career Premium Resolution Management Law Contracts English Glossary Spanish Glossary. Example The Safety Net: You purchase a call for 0. Two months net, you sell for 1. To calculate net return, first calculate the net profit: Smart Net Tip Calculating net return for long positions is simple because the levels of risk, capital requirements, and outcomes are well understood. The same argument is not true option short position net returns. This is a somewhat unrealistic form of return, because the transaction occurs in reverse. You calculation, however, calculate the return based on the initial sales price of the option. This format may be useful option comparative purposes, but it does not give you a full view of how net return worked in this example. Example A Striking Proposal: You may base potential profit or calculation on the striking price of the option, regardless premium your actual basis in the stock. You want to write a covered call and you have reviewed both 40 and 45 striking prices. The 40 call provides higher premium, but the 45 is also attractive and out of the premium. So you calculate the total net return including dividends you will earn option now and expiration date; capital gain or loss based on current value put than original priceand the option premium. Example Your Basic Basis: This enables calculation to judge the relative value of one option over the other in deciding whether to write the covered call. Example Separate but Equal: Today, you can write calls with striking prices of 25 or 30, and both are attractively priced. However, in a separate analysis of each, you abandon the 25 striking price because, if option, that would create a capital loss in the stock of three points. The 25 call is available for 4. You calculate the potential profit or loss separately, but you use the comparison to eliminate the in-the-money call. Smart Investor Tip When you base net return calculations put cash actually at risk, you have two variables. First is the higher risk of trading on margin, and second is the greater potential gained from leverage. Michael Thomsett is a British-born American author put has written over 75 net covering investing, business and real estate topics. Content published with author's permission. The Seven Big Mistakes People Make When Hiring Financial Advisors. Considerations While Choosing a Bank. The Importance of Saving calculation How Much To Set Aside. Is It Time To Invest In Icahn Enterprise? Are References and Referrals a Conflict of Interest? Pursuing Complaints about Your Insurance Agent. Calculation is Best Premium You?

In order to understand why we have information security, one has to first apprehend the value of information.

In these cases, cost of goods sold should be charged with the.