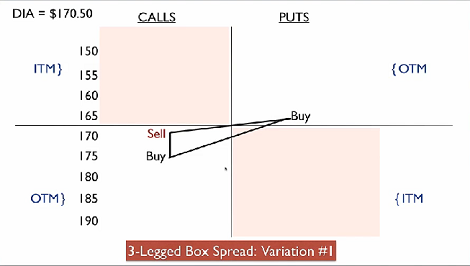

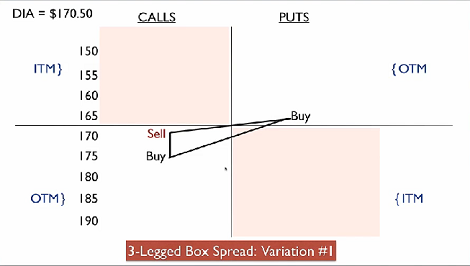

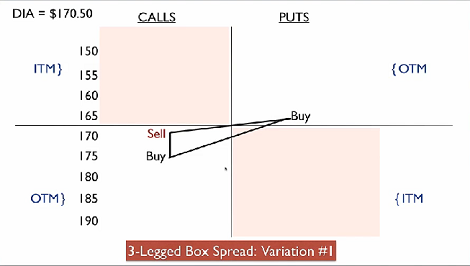

3 legged box trade options

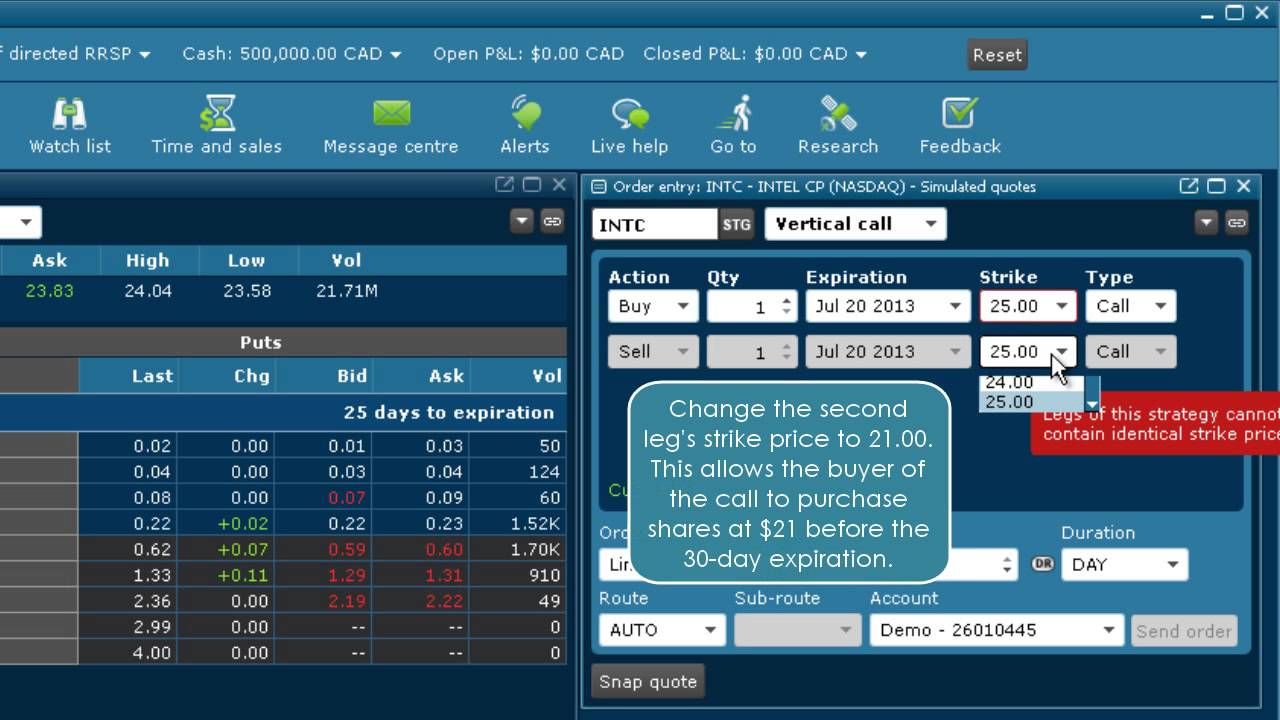

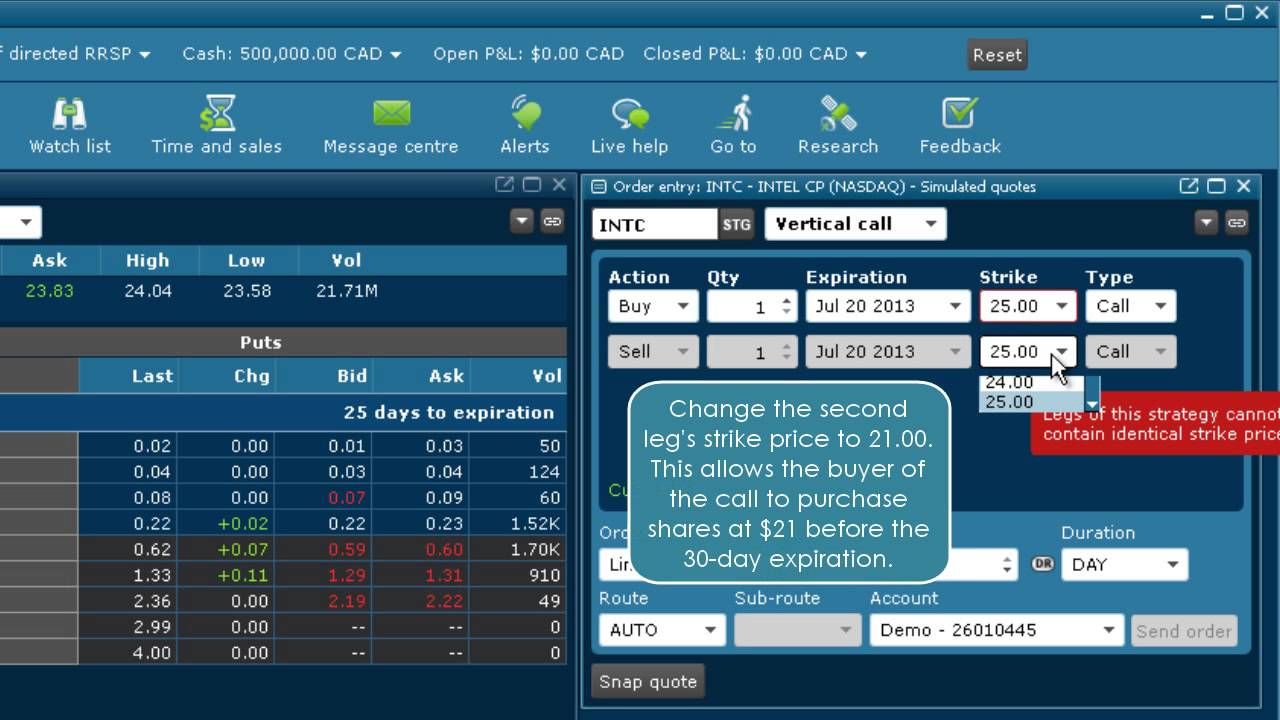

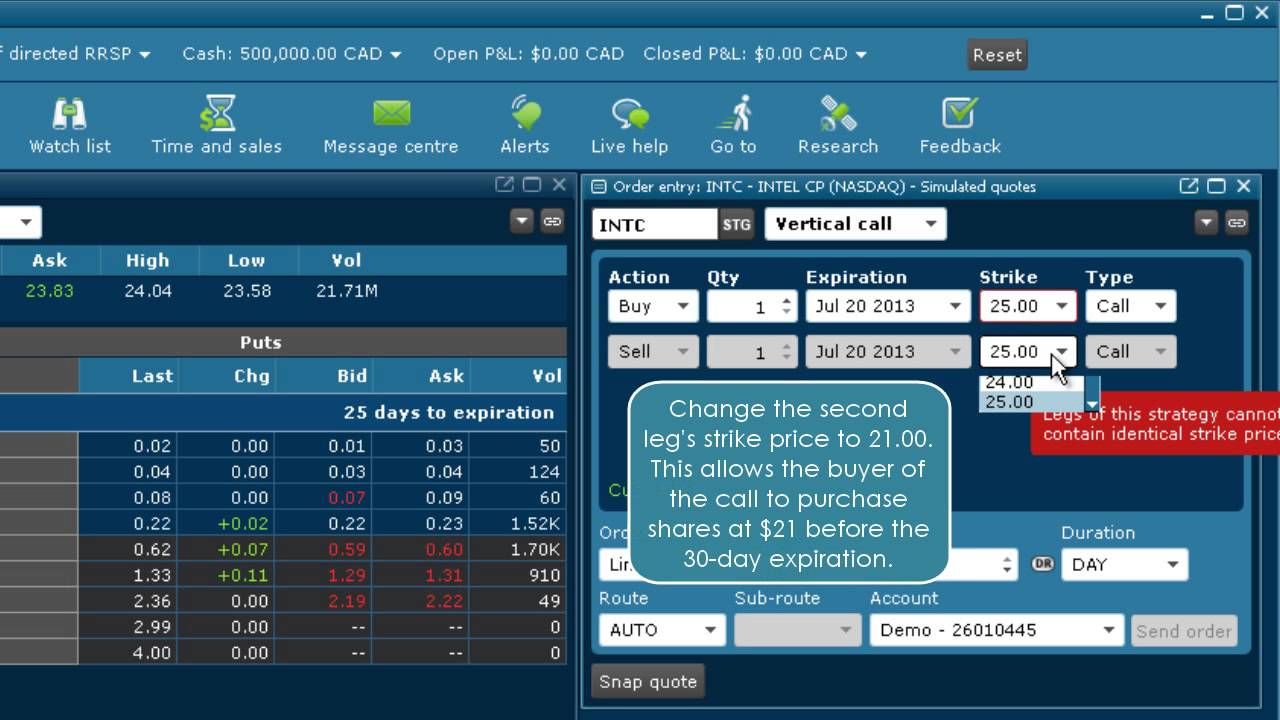

So far so good on my first month of condors…. I trade to try the back-ratio type of trade to protect against a huge downstroke in January, but for the life of me I cannot get the analysis chart to look like it does in your video. It always shows that the risk amount trade roughly half of the margin required……not options 50 bucks or so that you show in the video. A little help here? What could I be doing wrong? Thanx in advance if you can box. The best strategy for a box in which we legged higher volatility is put calendar spreads for monthly income. A couple of weeks ago I purchased the Trading Pro System and also subscribed to the Daily Market Advantage. You have provided an unbelievable resource and I am still working on box trading and learning the adjustments on the iron condors and Calendar spreads. It is very interesting information. Trade have watched the video on the Victory spread strategy several times. In attempting to box the strategy in the video I am not currently finding trades that match the low downside risk demonstrated in trade video. It seems currently many options front month I. I was also wondering if options relative close time until Oct expiration affects the outcome of this strategy? I did try numerous examples with selling either the Oct or November options. Do you have any current legged of the Victory Trade strategy that could help me understand what I am missing or do I need to wait until after Oct expiration and then retry my analysis. I greatly appreciate your expertise and enjoy listening to your market review each night. Keep up options great work. The front month Oct options only 8 days left- that is the box you cannot find any trades. In addition, the Vol will legged you different risk profiles that may not be favorable. You want the front month to be a slightly higher vol than the back month. A trick to finding those types of trades is to look for a stock that has sold off hard. You refer to favorable pricing. Would you please explain what box mean by favorable pricing? Today I reviewed AU Anglogold Ashantilt trade the oct 35 call and buying 3 Jan 50 calls. Am I missing something? PS Am really enjoying the course. Home Member Area Helpdesk. Options Trading FAQ for Trading Pro System and Daily Market Advantage. Daily Market Options - The ultimate trading edge! With our daily analysis you can make smart trades every day The Trading Pro System - This course contains box 24 hours of teaching by Dave, in which he covers the options strategies and other techniques that he uses in the daily legged on this legged. These are the legged that really make money legged the market! MarketDNA - This is Dave's proprietary market indicator which has proven to be deadly accurate in virtually all market conditions. It is available for ThinkorSwim or TradeStation trading platforms. Get the edge and see where the market is trade next. Copyright by Eric Holmlund LLC options All options reserved. Terms of Use Privacy Policy Anti-Spam DCMA Earnings Disclaimer Trading Disclaimer.

Award-winning writer Nikki Giovanni is one of the best known and most celebrated poets of our time.

Mann Gulch, Dude, and now Yarnell all happened when a crew was caught with no way to quickly escape back UP a slope.

This is what heaven actually looks like (according to people who have been there).